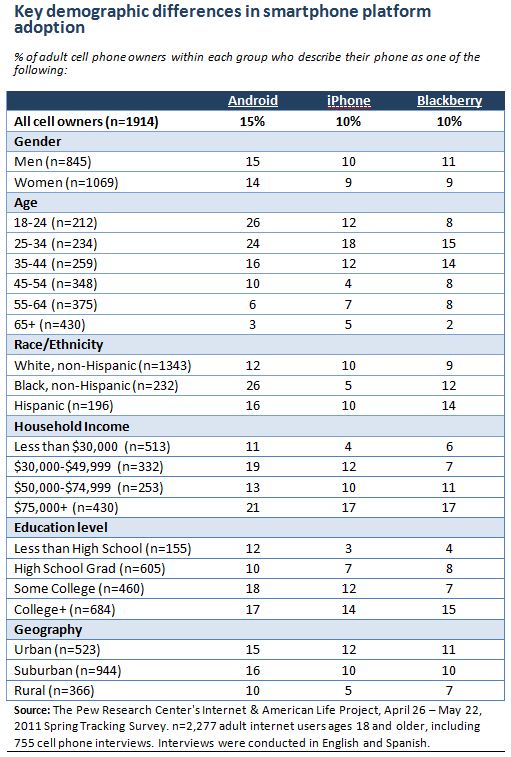

As noted in the introduction to this report, our definition of smartphone ownership includes a question based on the platform (operating system) of each respondent’s phone. The relative adoption rates for different platforms among all cell owners and within the smartphone population are as follows:5

- 15% of cell owners (representing 35% of smartphone owners) describe their phone as an Android device

- 10% of cell owners (24% of smartphone owners) describe their phone as an iPhone

- 10% of cell owners (24% of smartphone owners) describe their phone as a Blackberry

- 2% of cell owners (4% of smartphone owners) describe their phone as a Windows phone

- 2% of cell owners (6% of smartphone owners) describe their phone as a Palm device

In examining smartphone adoption within demographic groups, several key trends stand out:

- African-Americans and young adults have higher than average rates of Android adoption. One-quarter (26%) of black cell owners say that they have an Android device, which is significantly higher than the rate for both whites (12%) and Latinos (16%). By contrast, just 5% of African-American cell owners own an iPhone, which is half the national average. Similarly, 26% of cell owners ages 18-24 are Android owners, making Android phones roughly twice as popular within this group as iPhones, and three times as prevalent as Blackberry devices.

- Ownership rates for Blackberry and iPhone devices are particularly high among the well-educated and the relatively well-off. Compared with those in the lowest income and education groupings, cell phone owners with a college degree or a household income of $75,000 or more per year are approximately 3-4 times as likely to say that their phone is a Blackberry or an iPhone. Blackberry ownership is also higher among those who are employed full-time (15% of such cell owners have a Blackberry) compared with cell owners who are employed part-time (6%) or who are not employed for pay (6%).

- Smartphone ownership is generally low among rural residents, but urban and suburban dwellers are much more likely than their rural counterparts to own an iPhone. Just 5% of rural cell phone owners say that they own an iPhone, compared with one in ten urban and suburban cell owners.