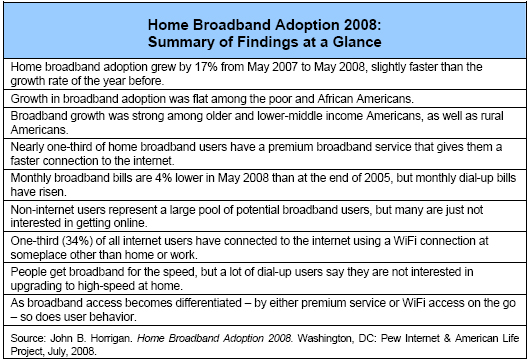

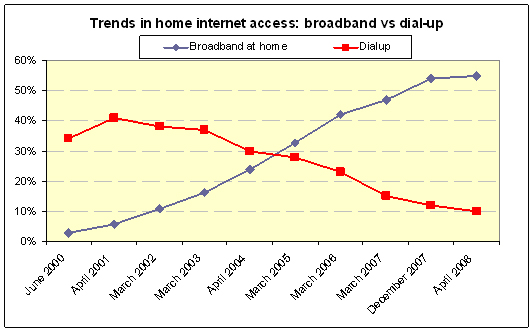

Home broadband adoption increased from 47% from March 2007 to 55% in April 2008.

Some 55% of adult Americans now have broadband internet connections at home, up from 47% who had high-speed access at home last year at this time. From the March 2006 to March 2007 timeframe, home broadband adoption grew from 42% of Americans to 47%.

The rate from March 2007 to April 2008 was 17%; this compares to the 12% growth rate from March 2006 to March 2007. It is also worth noting that the April 2008 number for broadband adoption at home is little changed from the 54% figure from the Pew Internet Project’s December 2007 survey. With growth in broadband at home, now just 10% of Americans have dial-up internet connections at home.

Growth in broadband adoption was flat among the poor and African Americans.

- 25% of low-income Americans – those whose household incomes are $20,000 annually or less – reported having broadband at home in April 2008. This compares to the 28% figure reported in March 2007 among those living in households whose annual incomes are $20,000 or less.

- African Americans showed slow growth as well, with 43% saying they had broadband at home in April 2008 versus 40% who said this in March 2007.

Broadband growth was strong among older and lower-middle income Americans, as well as rural Americans.

- Among older Americans – those age 50 and over – the growth rate in home broadband adoption from 2007 to 2008 was 26%. Half of Americans between the ages of 50 and 64 have broadband at home. Some 19% of those 65 and older had home broadband access as of April 2008.

- Americans with household incomes between $20,000 and $40,000 annually saw broadband penetration grow by 24% from 2007 to 2008. Some 45% of those in that income range reported having broadband at home in April 2008.

- 38% of those living in rural American now have broadband at home, compared with 31% who said this in 2007, or a growth rate of 23% from 2007 to 2008. By comparison, 57% of urban residents have high-speed connections at home now and 60% of suburban residents have such connections.

Nearly one-third of home broadband users have a premium broadband service that gives them a faster connection to the internet.

When asked whether they subscribe to a premium service that gives them a faster broadband connection or have basic service, here is what home broadband users say:

- 54% of home high-speed users have basic broadband service.

- 29% of say they have a premium service that offers faster speed.

- 16% responded that they do not know.

Monthly broadband bills are 4% lower in May 2008 than at the end of 2005, but monthly dial-up bills have risen.

- Broadband users reported an average monthly bill of $34.50 in April 2008, down from $36 in December 2005.

- The 4% decline is half the decline reported over the February 2004 to December 2005 time interval.

- Dial-up users reported monthly bills of $19.70, up 9% from the $18 figure from December 2005.

- The reported average cost of digital subscriber line (DSL) service ($31.50) continues to be less than cable modem service ($37.50). However, the $6 difference in April 2008 is smaller than the $9 difference in December 2005.

Non-broadband users cite a number of reasons for not using the service – including availability, price, and lack of interest.

- 62% of dial-up users say they are not interested in giving up their current connection for broadband.

When asked specifically what it would take them to get them to switch to broadband:

- 35% of dial-up users say that the price of broadband service would have to fall.

- 19% of dial-up users said nothing would convince them to get broadband.

- 10% of dial-up users – and 15% of dial-up users in rural America – say that broadband service would have to become available where they.

Attitudes about the relevance of information technology also shape the broadband decision for dial-up users, separate and apart from issues such as the price of service. Dial-up users are about half as likely as broadband users to say that information technology helps their personal productivity.

- When asked if they think electronic devices make them more productive, 35% of broadband users strongly agreed that it did compared with 19% of dial-up users.

Non-internet users represent a large pool of potential broadband users, but many are just not interested in getting online.

Roughly one-quarter (27%) of adult Americans are not internet users, and they tend to be older (the median age is 61) and have lower-incomes than online users (non-internet users are more than twice as likely as users to live in low-income households). Some 18% of non-internet users have used the internet in the past, but just 10% of non-internet users say they would be interested in joining the ranks of online users.

When asked why they don’t use the internet:

- 33% of non-users say they are not interested.

- 12% say they don’t have access.

- 9% say it is too difficult or frustrating.

- 7% say it is too expensive.

- 7% say it is a waste of time.

One-third (34%) of all internet users have connected to the internet using a WiFi connection at someplace other than home or work.

Some 34% of internet users have gone online via a wireless connection away from their home or office. This group of “on the go” WiFi users overwhelmingly have broadband at home; some 95% of those who have gone online this way have a high-speed internet connection at home.

Among internet users who have gone online “on the go” from some place other than home or work:

- 58% say they use WiFi at public places such as airports, coffee shops, or restaurants.

- 64% say they generally use free WiFi connections when they connect on the go,

- 32% say their on the go Wifi access is a mix of paid and free access.

- 4% mostly use paid services.

As broadband access becomes differentiated – by either premium service or WiFi access on the go – so does user behavior.

The 34% of online users who have taken advantage of “on the go” access and the 29% broadband subscribers who subscribe to faster premium services are more active online than typical broadband users. When looking across a range of 14 different online activities:

- Premium broadband users do an average 19% more online tasks on the typical day than the average broadband user.

- “On the go” internet users do an average of 26% more online tasks on a typical day than the average broadband user.

It is not too surprising that additional on-ramps to the internet are associated with heavier use. Nonetheless, particularly with respect to “on the go,” the results show that a WiFi-enabled laptop has added “always connected” wireless access to the “always on” broadband connection.